In-depth Q&A: Will the new global shipping deal help deliver climate goals?

Josh Gabbatiss

07.12.23Josh Gabbatiss

12.07.2023 | 8:57amNations have agreed on the firstnet-zero targetfor the global shipping industry, after fraught negotiations that ended in significant compromises on all sides.

Talks at the UN’sInternational Maritime Organization(IMO) in London last week ended with a decision that the sector would cut its greenhouse gas emissions to net-zero “by or around 2050”.

For the first time, there was also agreement on emissions “checkpoints” for 2030 and 2040, plus a pledge to roll out more low-carbon technologies by 2030.

A concerted push, led by Pacific island nations that are highly vulnerable to rising sea levels, saw countries agree to insert more ambitious language into the final text.

Meanwhile, large developing countries, including Brazil, India and China, made it clear that they viewed some of the targets being proposed as “unrealistic” and feared the economic burden that shipping decarbonisation could bring.

Shipping companies will need to undertake major changes in order to stick to the new targets. They will need to maximise energy efficiency and find low-carbon alternatives for their high-polluting fossil fuels.

The IMO targets are not legally binding, but provide a signal for the industry to follow in the coming years. Nations also agreed to establish legally binding measures to follow through on their pledges, potentially including a global emissions tax on shipping fuels.

In this article, Carbon Brief explains the key sticking points at the IMO talks and what nations ultimately agreed on emissions targets, levies and fuel standards.

- Why were nations meeting to decide on climate targets for shipping?

- Will new shipping emissions targets help the world reach its climate targets?

- What did nations decide about a carbon levy on shipping fuels?

- Did nations agree on setting global fuel standards for ships?

Why were nations meeting to decide on climate targets for shipping?

Global shippingproducesaround 3% of total greenhouse gas emissions. Responsibility for these emissions falls on the IMO, rather than individual nations, as international shipping is not covered by theParis Agreement.

Followingyears of delays, the 175 member states of the IMO finally agreed on a climate deal for shipping in 2018.

This so-called “initial strategy” was limited in its ambition. It set a target to peak emissions from international shipping “as soon as possible” and reduce them by “at least” 50% by 2050 compared to 2008.

While notable, this goal wasnot in linewith the Paris Agreement’s targets to limit warming to “well below” 2C while pushing to keep it below 1.5C, in spite of a reference to “a pathway of CO2 emissions reduction consistent with the Paris Agreement temperature goals”.

However, the option of more ambition was kept on the table, with a statement within the strategy noting that it was only the “first milestone” on a longer journey. Nationsagreedto adopt a “revised IMO strategy on reduction of greenhouse gas emissions from ships” in 2023.

This was set to take place at the 80th session of theMarine Environment Protection Committee(MEPC80), which happened at the IMO headquarters on the banks of the Thames in London from 3-7 July.

MEPC80 was preceded by the15th Intersessional Working Group on Greenhouse Gases(ISWG GHG 15), where countries tried to set the groundwork for an agreement the following week. At the conclusion of that event, partiesseemedfar from reaching a conclusion.

Negotiations remained tense throughout the week at MEPC80. However, on Friday morning it was clear that a final deal had been reached.

During a plenary session attended by Carbon Brief, the chair, Liberian representative Harry Conway, told delegates:

“This is a historic moment for IMO. In the past, when a committee has faced challenging decisions, we have sought silence as a way of agreement. However, I think what we have in front of us is an easy decision to make.”

He invited those present to welcome the new agreement with a round of applause.

Following the agreement, parties issued statements that made it clear that all sides felt there had been significant compromises.

Pacific islands and Latin American nations, which had found themselves clashing over key issues, thanked each other for their flexibility.

Despite this general goodwill, some still made their displeasure known. The representative from India, for example, said “this delegation still maintains its concerns over unrealistic targets”, echoing concerns voiced by China and others.

The new strategy is not legally binding, but the tools devised at the IMO to implement it could be. Nations have already agreed on “short-term measures”, which entered into force this year, to report on energy efficiency and carbon intensity of ships – althoughcritics saythey will have minimal impact.

Another key part of the new strategy is a decision to move forward on the next round of “mid-term measures” to drive down emissions, potentially including mandatory low-carbon fuel standards and emissions taxes. These will not enter into force until 2027.

Dr Tristan Smith, aUniversity College Londonshipping researcher who follows the IMO talks closely, tells Carbon Brief that these will, ultimately, be the key outcomes from the strategy:

“What matters is how it is operationalised into a policy measure…which creates the legal force of compliance requirements and enforcements at national jurisdiction level.”

Will new shipping emissions targets help the world reach its climate targets?

Thefinal IMO agreementcontains several headline goals, perhaps most notably to peak greenhouse gas emissions from international shipping as soon as possible and reach net-zero emissions “by or around, i.e. close to 2050”.

For the first time, the agreement also contains interim “checkpoints” – a move endorsed by the shipping industry and pushed by high-ambition nations.

Countries agreed to cut total shipping emissions by “at least 20%, striving for 30%” by 2030, from a baseline of 2008. They also agreed to cut emissions by “at least 70%, striving for 80%” by 2040, compared to 2008.

The strategy contains other targets, including a commitment to reduce the carbon intensity of international shipping by 40% by 2030, compared to a 2008 baseline. This is a remnant from the initial IMO strategy.

More ambitious “striving” goals came after lobbying by Pacific island nationsright downto the final evening of the summit. They were opposed by large emerging economies including China and Brazil.

“Pacific island countries always come with the highest ambition and push to the end for it,” Vanuatu climate minister Ralph Regenvanu told journalists earlier in the week.

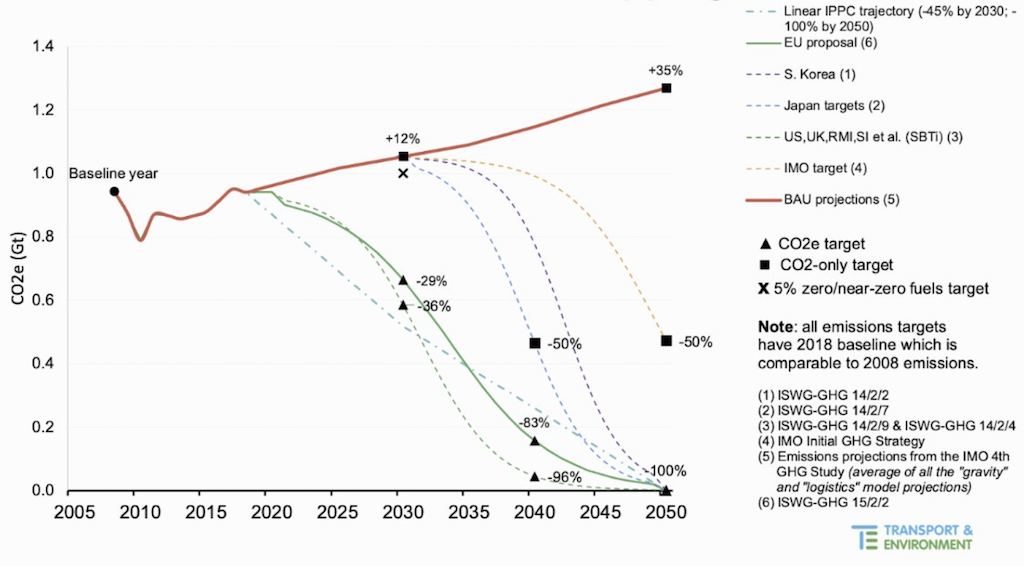

In the run-up to the meeting, it had swiftly become apparent that nations had very different views about how ambitious they wanted these emission targets to be. Some of the proposed pathways can be seen in the chart below made by NGO groupTransport and Environment.

Fiji, the Marshall Islands, the Solomon Islands and Vanuatu proposed a 2030 target of 37% emissions reductions and a 2040 target of 96% reductions. Japan, a major shipbuilder, proposed a mere 50% cut by 2040.

Meanwhile, a group of predominantly large, emerging economies that included big fossil fuel producers such as Saudi Arabia, China and the United Arab Emirates (UAE)submitteda proposal that included a net-zero target “preferably around mid-century and before the end of this century”.

This helps to explain the relatively vague language attached to the mid-century net-zero target in the final agreement. Previously, the EU and others had called for a target of “2050 at the latest”.

Much was made of the ultimate failure to align the emissions goals with a pathway that would limit global warming to the Paris Agreement target of 1.5C.

Targets proposed by high-ambition nations were aligned with sectoral carbon budgets said to be in line with 1.5C, according to theScience Based Targets Initiative(SBTi).

(The SBTiderives sectoral budgetsfrom the overall carbon budget set out by theIntergovernmental Panel on Climate Change(IPCC), combined with other research.)

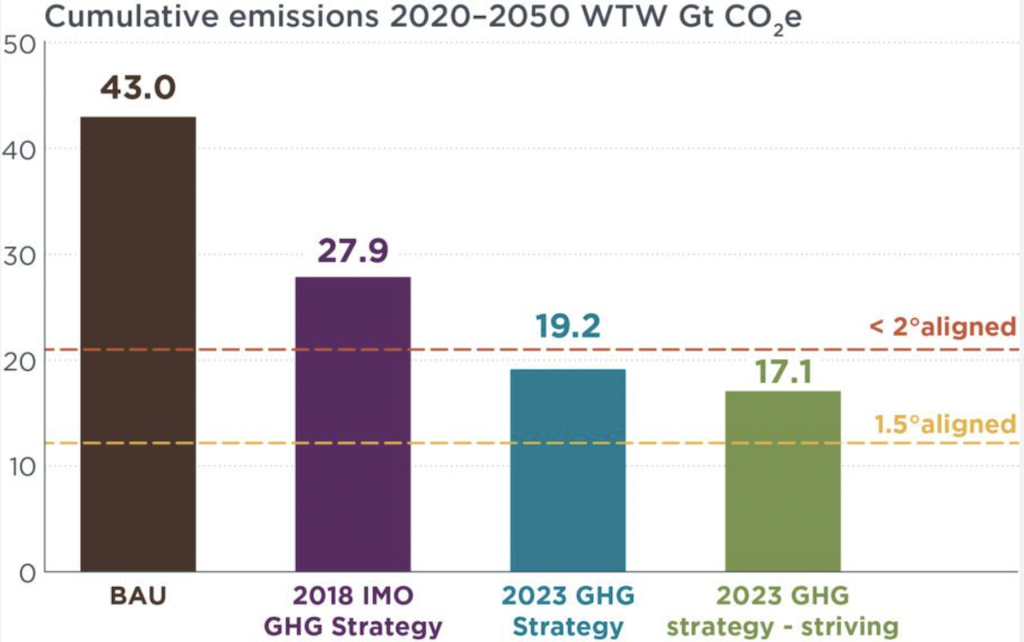

yabo亚博体育app下载by theInternational Council on Clean Transportation(ICCT) says that while the revised strategy is not compatible with its own estimate of a 1.5C carbon budget for shipping, it is compatible with the Paris Agreement limit of “well below 2C”.

As the chart below shows, this is an improvement on the previous IMO strategy, which, according to the ICCT, would have blown past a “well-below 2C” budget by 2037.

(In a briefing note sent to other developing countries and seen by Carbon Brief, China said it opposed higher ambition because “only emphasising the 1.5C temperature goal” would be “inconsistent” with the Paris Agreement.)

The strategy will be reviewed in 2028.Experts sayit is likely that the targets would then be brought closer in line with sectoral carbon budgets implied by the 1.5C goal. Several island nations made the case for this in their closing remarks at the event.

China pushed back against the need for emissions targets to cover the entire life-cycle of fuels, from extraction, refining and processing through to use – known as “well-to-wake”.

In a diplomatic memo circulated by China and seen by Carbon Brief, it argued that including land-based process emissions within controls under the IMO regime would “transfer[] the national emissions reduction responsibility to [the] international shipping industry”.

However, in the end, the final agreement said any emissions-cutting measures “should take into account the well-to-wake greenhouse gas emissions of marine fuels…[to prevent] a shift of emissions to other sectors”.

This is important as, otherwise, fuels that produce no greenhouse gas emissions when combusted on board a ship, such as hydrogen, could be made on land in an emissions-intensive manner – using coal, for example.

Another point of contention was the definition of the 2030 and 2040 emissions goals not as “targets” but rather as “indicative checkpoints”.

Dr Lucy Gilliam, a senior shipping policy officer withSeas at Risk, tells Carbon Brief that this language was important to certain countries that were “less progressive” at the talks. However, she says, ultimately, it comes down to how the shipping industry interprets these “checkpoints”:

“We’re going to be saying to people: we need to think of these as targets, because we really do need to be aligning the sector with 1.5C.”

Broadly, the shipping industryreactedto the outcome withenthusiasm.

In a statement sent to Carbon Brief, Simon Bergulf, head of energy transition and operations at Danish shipping companyMaersk, says the net-zero goal sends a “powerful message” to the industry and maps “a clear path ahead”.

Smith says that the IMO strategy could have immediate implications for the industry. This could include the cancellation of orders for ships that use liquefied natural gas, he says, as well as a boost for biofuel producers.

Solomon Islands shipping adviserMichael Prehntells Carbon Brief that, in his view, “from now on, all new ships will have to be able to sail on zero-greenhouse gas fuels”.

The final targets included in the new strategy were new commitments to achieve 5%, “striving for” 10%, “zero or near-zero greenhouse gas emission technologies, fuels and/or energy sources” in shipping by 2030.

Such goals have beenchampionedby industry, as they are expected to help stimulate the use oftechnologiesthat are in earlier stages of development.

What did nations decide about a carbon levy on shipping fuels?

The idea of a carbon levy on shipping fuels has beengathering momentumat internationalclimate eventsin recent months. This came to a head at the IMO meeting in London.

A diverse group of developed and developing nations, vocally led by a group of Pacific island states, made a strong case for a levy and gained wide support for their proposal. They called for every ship to pay a carbon tax, based on the greenhouse gases their fuel generated.

Meanwhile, a smaller – but influential – group, comprising China, Brazil and several other large developing countries, as well asAustralia, opposed the idea.

最后,征收agreem进入决赛ent as part of a “basket” of suggestions alongside other proposals from nations and industry groups for decarbonising shipping. The IMO strategy says these options “should be developed and finalised” over the next year.

One or more of these elements will end up as the “economic element” of the global plan to actually achieve the IMO’s emissions targets.

This would be alongside the “technical element”, which islikely to bea global limit on the emissions intensity of shipping fuels. IMO members agreed that these “mid-term measures” will be approved by 2025 and will enter into force in 2027.

Going into the IMO talks, a shipping levy proposal championed by the Marshall Islands and the Solomon Islands hadgathered supportfrom more than 20 nations at a key climate finance summit hosted in Paris at the end of June. This included a mix of countries, but predominantly European and small-island states.

In their proposal, a “universal, mandatory” emissions levy would have been applied to all shipping fuels from 2025, with an initial price of $100 per tonne of CO2 equivalent “subject to five-yearly reviews and irreversible ratchets”. Estimates suggest that this would have initially generatedat least$60bnper year.

During the working group talks that preceded the main IMO summit, more countries came out in favour of a levy.

At least36 nations openly voiced their support for some kind of levy at the workshop ahead of the meeting.

Nevertheless, observers tell Carbon Brief they were not prepared for the strength of opposition to the levy at the ISWG GHG 15 workshop. This came as Chinacirculateda note, seen by Carbon Brief, which framed the levy as a “developed country” proposal.

This was dismissed as “disinformation” by Vanuatu climate minister Ralph Regenvanu at a press conference, as he pointed out that the levy’s strongest supporters were developing Pacific island nations. It also had support from parts of Africa, Asia and the Caribbean.

Nevertheless, at least 18 nationsstatedbefore the MEPC80 meeting that they wanted to exclude the levy from the proposed measures.

Some countries rallied around a proposal from China dubbed the International Maritime Sustainable Fuels and Fund (IMSF&F) mechanism.

Instead of a levy, the IMSF&F would involve incentivising decarbonisation by providing ships that stay below a certain emissions limit with credits and making those that exceed the limit either purchase credits from others or pay into a “sustainable shipping fund”.

A key objection to the levy, voiced by South American nations, was that it would amount to a tax on distance travelled and would, therefore, have a detrimental effect on trade. They argued that their geographic isolation and reliance on export of relatively low-value products left them particularly vulnerable to the impacts of the measure.

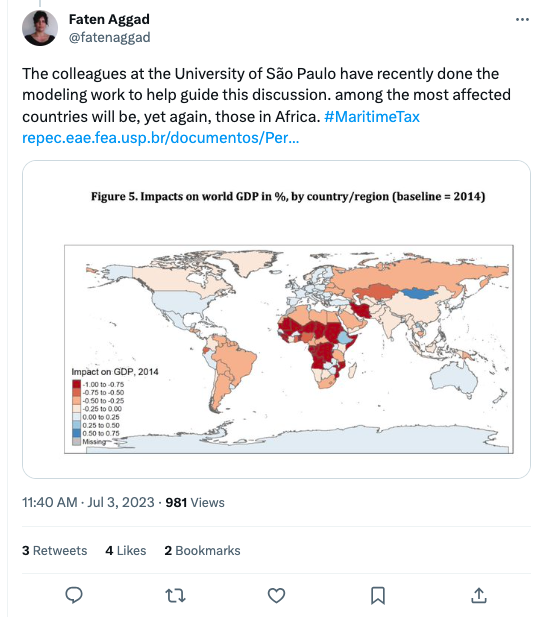

Astudyby researchers at theUniversity of São Paulo,citedby the Brazilian delegation, supports this notion. It concludes that a $50/tCO2 levy could cut shipping emissions by 7%, but also “decrease…global exports and GDP in middle- and low-income countries” and “exacerbate regional inequalities across the globe”.

However,Dr Tristan Smith, aUniversity College Londonshipping researcher, tells Carbon Brief he questions these concerns:

“They are valid because transport costs do affect demand and trade, but, in most analysis done to date, the South American economies are not the most negatively impacted.”

事实上,太平洋岛国support the levy are among the worst affected, alongside other small islands and least-developed countries. The University of São Paulo study suggests Africa would be the continent that feels the effects most.

史密斯还指出,国际海事组织过程包括s a mechanism to address “disproportionate negative impacts”, which could be used to iron out these issues.

Much of the emphasis on the shipping fuel levy at other climate events has been on its potential to raise money that could be used to support climate spending in developing countries.

But Solomon Islands adviserMichael Prehntells Carbon Brief that this was not the primary role they envisaged for the levy:

“It creates economic pressure to do the transition. That is the primary function. The secondary function is to create a pile of money. Our idea has always been first to create the levy and, if the levy creates revenue, then we’ll find out how to distribute the revenue.”

In their initial proposal, the Solomon Islands and their allies said any revenues should “ensure an equitable transition is available to all member states”. Developing countries will likely need financial support to help them decarbonise shipping.

This is significant, not least because of thelingering mistrustbetween developing and developed countries over traditional climate finance.

Against this backdrop, Gilliam from Seas at Risk tells Carbon Brief that some developing countries were not happy about the idea of contributing to climate finance for other developing countries:

“[They are] calling out developed nations and saying ‘money for climate adaptation andloss and damage, developed countries should have already paid for that, they shouldn’t be looking to the IMO and a global shipping levy’.”

(A diplomatic note circulated at the meeting by China and seen by Carbon Brief said that using a shipping levy to fund the UN’s Green Climate Fund would “make developing countries bear the climate change financing responsibility which should be borne by developed countries”.)

On top of the proposals from Pacific islands and China, other parties also came forward with their own ideas to price shipping emissions.

These include trade body theInternational Chamber of Shipping(ICS)proposinga “fund and reward mechanism” that would see shipping companies that switched to low-carbon fuels being rewarded with money from a carbon levy. Japan similarly proposed a “feebate” system that would include rewards for ships that chose cleaner fuels.

Most of these ideas about how carbon pricing could work and what it would fund are captured in the final agreement. A Norwegian proposal for a global shipping emissions trading scheme was left out.

The IMO now has a timetable to choose which elements to go ahead and implement, informed by a “comprehensive impact assessment” of the different options, which will be ready by 2025. Any new pricing measures will not come into effect until 2027 – just three years ahead of the first emissions checkpoint.

NGOs werecriticalof the slow progress on carbon pricing. However, according to shipping advisory serviceUMAS, of which Smith is a member:

“Many may be frustrated that the timescales are not shorter…However it is hard to see how the IMO process could have moved this much faster.”

Did nations agree on setting global fuel standards for ships?

Besides the “economic element”, potentially consisting of emissions pricing, nations also agreed to develop a “technical element” to help cut emissions from international shipping.

This will come in the form of a “goal-based marine fuel standard”. This would set limits on the amount of emissions shipping fuels can produce, which then decline over time.

From the outset, there was far more agreement on this issue than on the proposed emissions levy.

An EU proposal for a global fuel standard has seen growing support across recent IMO meetings and proved the most popular at MEPC80, according toUMAS.

It includes a market-based element, where shipping companies could purchase “remedial units” if they exceed emissions limits. Money from those sales could be used to subsidise low-carbon fuels.

The idea is that a price would be set at a level that discourages companies from exceeding those fuel-standard limits.

许多国家支持这个想法在年代hipping fuel levy. In this combination, the fuel standard would provide long-term certainty and proceeds from the levy could be used to help further close the price gap between fossil fuels and low-carbon fuels.

However, observers tell Carbon Brief that a handful of developing countries backed the EU’s global fuel standard without lending their explicit support to the levy.

As with the proposals for emissions pricing, these “technical” measures will be hashed out over the next two years, with approval expected in 2025. They are then set to come into force in 2027.

-

In-depth Q&A: Will the new global shipping deal help deliver climate goals?