欧盟电力下降17%的化石燃料的使用to ‘record low’ in first half of 2023

Molly Lempriere

08.29.23Molly Lempriere

29.08.2023 | 11:01pmThe amount of electricity generated by fossil fuels across the European Union (EU) fell to its lowest level since records began in the first six months of 2023, according to a newreportfrom energy analystsEmber.

Electricity generated from coal collapsed by 23% and gas fell by 13%, compared with the same period a year earlier.

At the same time, solar generation increased by 13% and wind power output by 5%.

This allowed 17 EU countries to generate record shares of power from renewables. Greece and Romania both passed 50% renewables for the first time, while Denmark and Portugal both surpassed 75% renewables.

The fall in the reliance on fossil fuels was driven mainly by a “significant” drop in electricity demand amid high gas and power prices, according to Ember. It adds that the EU will need to accelerate the deployment of low-carbon power to accommodate for demand recovering while keeping on track for climate goals.

The report shows that over the first six months of 2023:

- The structural decline of coal has continued, despite the volatility in the power market in the EU.

- Solar generation increased 13% in comparison to the same period the previous year.

- Wind capacity expansion has been hit by policy challenges and increased prices.

- Nuclear generation fell by 3.6%, but French nuclear output has increased since April and is expected to continue to rebound throughout the year.

- Electricity demand fell by 5% to a record low of 1,261TWh, largely due to high power prices.

Fossil fuel falls

在整个欧洲,在th化石燃料发电成本下降e first six months of 2023. Generation from coal and gas decreased by 86 terawatt hours (TWh, 17%), with fossil fuels generating 410TWh (33%) of demand, according to Ember.

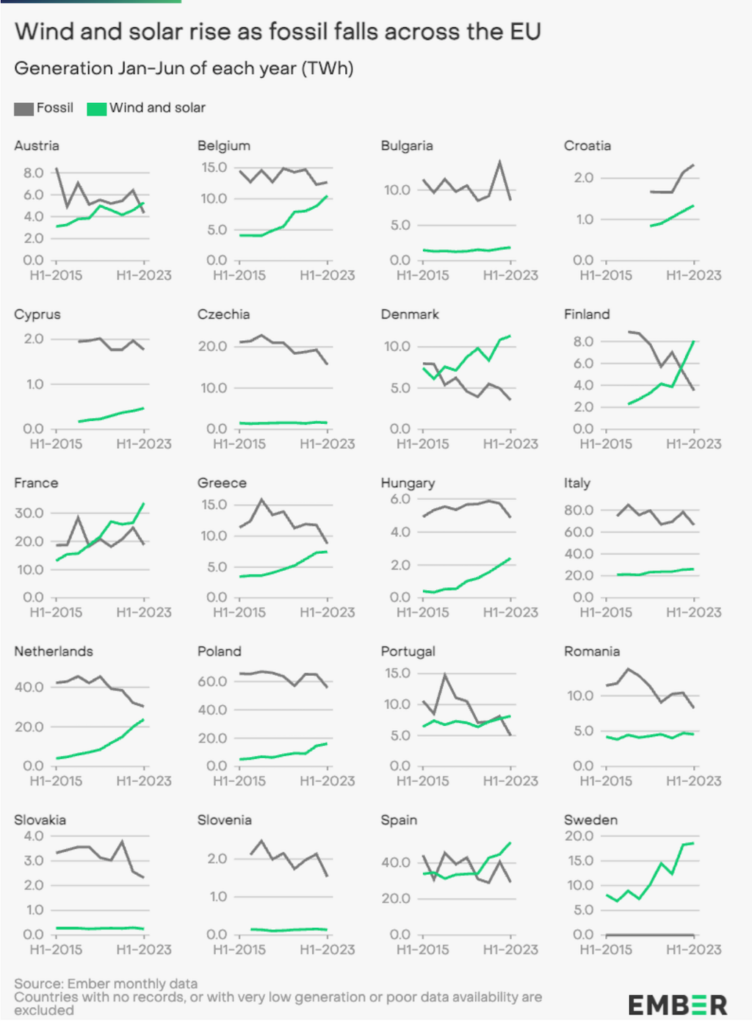

There were 11 countries that saw a fall of at least 20% and five – Portugal, Austria, Bulgaria, Estonia and Finland – where fossil fuel generation fell by more than 30% during the first half of 2023.

Records were set for the lowest total fossil-fuel generation for the period in 14 countries, with Austria, Czechia, Denmark, Finland, Italy, Poland and Slovenia at the lowest fossil output since at least 2000.

Several countries saw significant periods without any of the fossil fuels that “have traditionally been bedrocks of their power systems”, the report notes.

This includes the Netherlands, which only used coal on five days in June, and saw a record 17 consecutive days with no coal use. Similarly, Greece went for 80 hours with no brown coal (lignite) on its power system in July.

Coal, in particular, fell by a “staggering” 23%, according to Ember, accounting for just 10% of the EU’s electricity generation in May – the lowest share ever recorded.

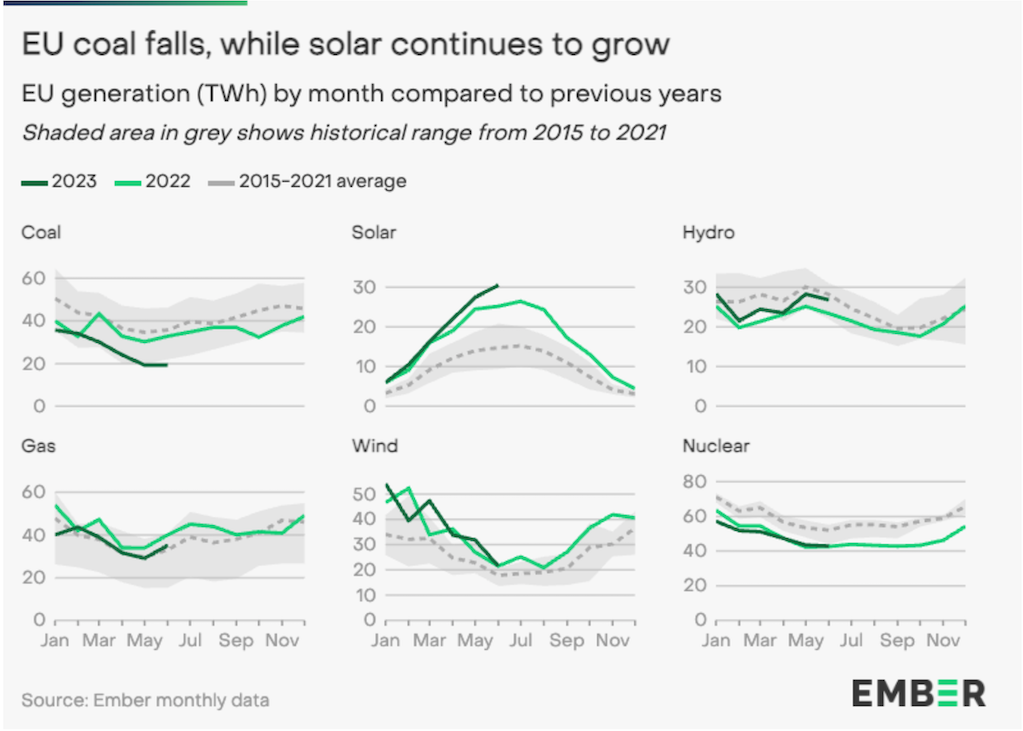

每月黑暗gr显示欧盟煤炭发电een line in the top left figure below, compared with last year (light green) and the average (dashed line) and range (grey shading) for 2015-2021.

Thestructural decline of coalhas continued, despitevolatilityin the power sector since the Russian invasion of Ukraine, which led to the suggestion of acoal comeback.

Last year saw coal generationrise by 7%compared to 2021, in part, because coal units were kept online asemergency capacity, with Germany, Italy, the Netherlands, Greece and Hungaryall announcing plansto extend the lifetime of coal plants, re-open closed plants or lift caps on coal-burning hours.

In 2021, coal generated15%of EU electricity (436TWh), up from a historic low of 364TWh in 2020 when Covid-19 caused significant demand reduction.

The reduction in coal power across the EU over the first half of 2023 has returned the decline in the use of the fossil fuel to its pre-pandemic trajectory.

Over the first six months of 2023, gas-fired generation fell by 13% (33TWh), according to Ember.

Russian gas pipeline imports fell by 75% to 13bn cubic meters (bcm) during the period, down from 50bcm in the first half of 2022.

As alternatives to Russian gas supply were sourced and storage across the EU replenished, gas prices fell below thespikesseen in 2022. This contributed to the fall in coal use over the first six months of 2023, in comparison with the previous year.

According to theEuropean Commission, the EU has already reached its target of filling gas storage facilities to90% of capacity, around two-and-a-half months ahead of the 1 November deadline.

Gas storage levels have reached 1,024TWh, or 90.12%, of storage capacity. This is equivalent to just over 93bcm of gas.

This increased storage should help keep coal demand and power prices lower than last winter, says Ember.

Sunny outlook

While the use of fossil fuels has continued to fall, renewable energy capacity has soared over the first half of 2023 – and, in particular, solar power.

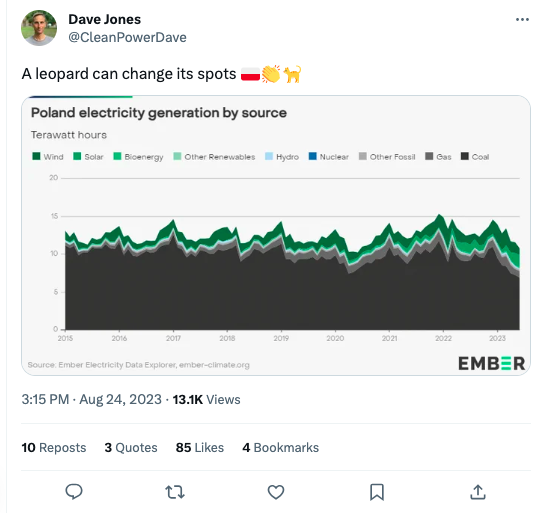

After record-breaking capacity additions of 33 gigawatts (GW) of solar in 2022, the pace has continued in 2023. This includes:

- Germany adding 6.5GW (+10%) of new solar capacity.

- Poland adding over 2GW (+17%).

- Belgium adding at least 1.2GW (+19%).

- Italy installing 2.5GW of solar in the first six months, compared to a total 3GW installed across the whole of 2022.

- France adding at least 0.6GW in the first quarter of 2023, significantly above its deployment over the same period last year.

- Spain being expected to accelerate its deployment from 4.5GW in 2022 to 7GW this year.

Ember notes that the growth of solar is likely to be an underestimate of the true scale of solar expansion, given many countries do not report “behind-the-meter”, meaning solar systems such as residential rooftops that can be used on site without passing through a meter into the wider system, which instead appears as “missing” demand.

The wind sector has continued to grow in the first half of 2023 as well, but to a lesser extent. Ember attributes this to various barriers.

France was notable for its growth, with more than 0.85GW of wind added in the first quarter of 2023. Germany added 1.5GW of wind capacity between January and June.

For offshore wind, less than 2GW of capacity was added across the entire EU in the first six months of 2023.

This is, in part, because of rising project costs for wind technology, with the cost of a wind turbine having risen by38%over the past two years, according to astudyfrom consultancy Oliver Wyman. (Despite this increase, renewables remain the cheapest source of electricity, with the cost of onshore wind falling by5% in 2022according to theInternational Renewable Energy Agency). This increase, driven by wider inflationary cost pressures and higher interest rates, is having a detrimental effect on investment in projects.

Additionally, individual member states have policies that are hindering deployment, according to Ember. For example, the administrative approval process inFranceis slowing down deployment of onshore wind. There is a lack of political will in the country to change this, given local opposition to the technology, according to news and data siteMontel.

Despite the relatively small growth for wind during the beginning of 2023, the EU industry remains enthusiastic about its future, Ember says.

There is evidence that changes are being made to counter the slowdown in deployment, the think tank notes, includingpolicy change in Polandto reduce the distance turbines need to be from residential buildings and a concerted effort by the European Commission to tacklepermitting delays.

Unusually windy weather in July also meant existing capacity outperformed the same month the previous year by 22% (5.5TWh).

Overall, wind and solar accounted for more than 30% of electricity production in the EU for the first time in both May and July – and surpassed total fossil-fuel generation in May.

This follows wind and solar supplying more of the EU’s electricity than any other power source for thefirst time in 2022, according to a previousreportfrom Ember.

Fossil fuel use has fallen across almost all EU countries (grey line) over the first half of 2023, while renewable have grown across almosts all (green line) as shown in the graph below.

In the first half of 2023, Portugal saw more than 75% of its electricity share coming from renewables, primarily wind and solar, which accounted for more than half of total generation in both April and May.

After 140 hours in which wind and solar produced more than the entire country’s consumption, the Netherlands also hit 50% wind and solar for the first time in July. Germany also came close, with a record 49% share of renewables in July.

However, the need for measures to help further integrate variable output from wind and solar is “becoming more pressing”, says Ember.

“Negative” prices – where users are paid to use electricity – are becoming increasingly frequent, the report notes. It says these periods, usually caused by high renewable output pushing electricity supply above demand, can be disruptive, causing market distortion that hurt wind, solar and other clean electricity sources.

Grid congestion – where there is not enough capacity to transport electricity – is also becoming increasingly challenging, Ember says. For example, it says that 19% of “behind-the-meter” solar in Spain had to be “curtailed” in 2022, meaning it was wasted.

The report notes:

“For Europe to unlock the full potential benefits of wind and solar to cost, security and climate, these limitations need to be addressed in systems planning and supportive infrastructure.”

Uncertain nuclear and hydro

There was some improvement in output seen across both the nuclear and hydropower sectors in the EU over the first six months of 2023, but numerous challenges continue to make their future uncertain, Ember says.

Hydropower generation increased by 11% (+15TWh) between January and June, driven by higher output in Southern Europe and the Baltic states after last year’srecord drought.

The Nordic countries saw similar performance levels to 2022, staying below 2021 levels, according to Ember.

Overall, water levels in reservoirs across the continent were higher. French reserves were almost 400 gigawatt hours (GWh) higher, for example, leading to better performance than last year, although still below recent averages.

European hydro has been increasingly limited and volatile since 2000, exacerbated in recent years by severe drought. This was particularly evident in2022, when energy production from run-of-river plants (those that harness the natural downward flow of water, for example channelling a river through a turbine system) over the first six months of the year were lower than the 2015-2021 average in Italy (-5.039TWh compared to the average), France (-3.93TWh) and Portugal (-2.244TWh), according to theEuropean Commission.

Hydropower reservoir levels were also affected in countries such as Norway, Spain, Romania, Montenegro and Bulgaria, among others.

“Given escalating climate impacts, consistent output cannot be relied upon,” notes the Ember report.

In the first six months of 2023, nuclear generation fell by 3.6% (11TWh) compared with the same period a year earlier, according to Ember. This was largely due to theGerman nuclear phase-out, the closure of theBelgian Tihange 2nuclear plant, outages inSwedenand ongoing issues with theFrench fleet.

Significant French nuclear outages in 2022 had a knock-on impact across Europe, having a particular impact on energy security and leading the UK to become anet exporterfor the first time in 12 years. This was due to 56 of EDF’s nuclear reactors across France running at less than half capacity as of September 2022, due to outages and urgent maintenance.

Over the first three months of 2023, French nuclear output was 6.2% (6.8TWh) lower than in 2022. However, the “near-term future looks a bit brighter”, Ember notes, with French reactors outperforming 2022 by 18% in April through June (11TWh).

Additionally, by the end of the year 93% of French nuclear capacity is forecast to be available to generate electricity after prolonged outages last year.

EDF has confirmed its prediction of300-330TWh for 2023, after output had fallen to279TWh in 2022, the lowest level since the 1980s.

Elsewhere, the opening of the long-delayedOlkilutot 3nuclear plant in Finland is now partly offsetting closures elsewhere.

However, the outlook for nuclear generation in the EU over the next few years remains uncertain, according to Ember.

It notes that whileBelgium is delaying its nuclear exit– planned for 2025 originally – France is only anticipating gradual improvements to nuclear output, with a full recovery some time away. Even EDF’s upper bound forecast for 2025 (365TWh) is still well below the average of 410TWh from 2011-21.

High prices lower demand

The significant drop in electricity demand over the beginning of 2023 was predominantly due to high gas and power prices, according to Ember.

Electricity demand fell by 5% to a record low of 1,261TWh. This is even lower than the 1,271TWh demand seen in the same period in 2020 due to the pandemic. This is the lowest level of demand since at least 2008 for current member states.

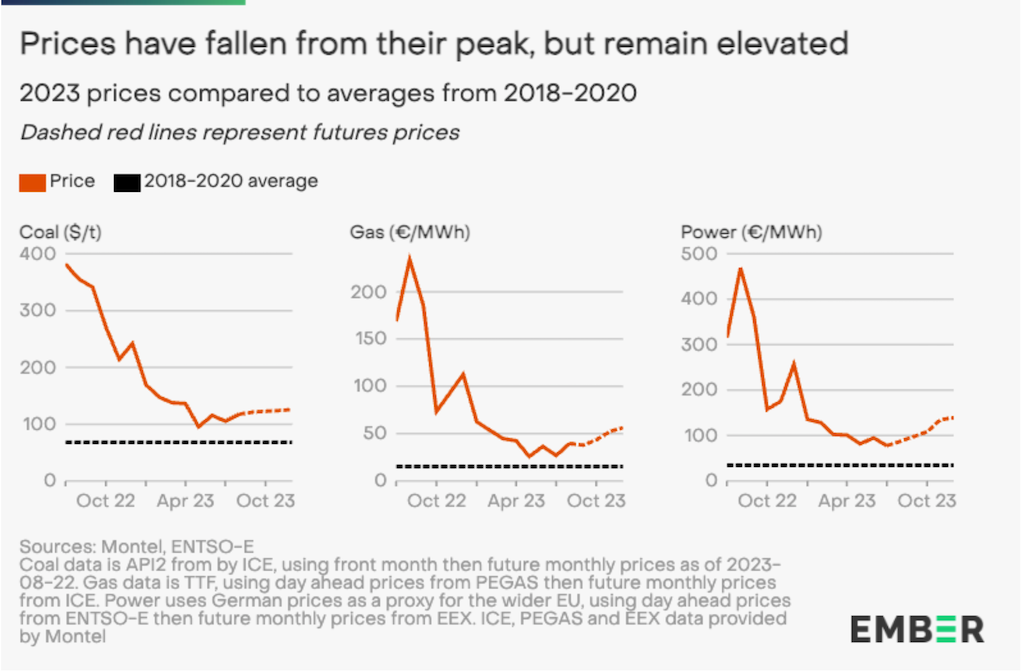

Average gas prices between January and June 2023 were €44 per megawatt hour (/MWh). This is a drop of 50% compared to the levels seen in the same period the previous year of €97/MWh. However, this is still double the prices in the first half of 2021, at €22/MWh, notes the report.

Gas prices are expected to stay high for the rest of the year based on forward prices, says Ember. The relative calm of the gas market in recent months has also been rocked by the threat of strikes atthree major liquefied “natural” gas sitesin Australia in August.

This has acted as a “reminder that the risks of gas price surges remain, increasing as winter and the heating season approach”, says Ember.

Coal prices have mirrored gas prices over the first half of 2023.Rotterdam prices(the European benchmark) have averaged $134/tonne, compared to $275/tonne in the first half of 2022. Like gas, this is still more expensive than before the crisis, with prices of $78/tonne in the same period in 2021.

Given the price-setting role of fossil fuels in Europe’s power system, electricity prices are expected to remain high, according to Ember’s analysis. Prices averaged at €107/MWh for January to June 2023, a drop of more than 40% compared to the same period in 2022 (€185/MWh), but still twice the price in the first half of 2021 (€55/MWh).

Prices across coal, gas and power (shown in the graph below) have all fallen from the highs seen in 2022, but remain above the historic averages.

High power prices helped drive down electricity demand by 4.6% (61TWh) in the first six months of 2023, Ember says.

In addition, between November 2022 and March 2023, the European Commission introducedmeasuresto cut EU electricity demand in response to the energy crisis.

This included introducing anobligationto reduce electricity consumption by at least 5% during selected peak price hours, and overall electricity demand by at least 10% until 31 March 2023 for example. Nearly all member states succeeded in reducing their consumption over that period.

Areportfrom theInternational Energy Agency(IEA) attributed two-thirds of the demand decline in 2022 as a whole to non-weather related factors – in particular, the reduction in output from energy-intensive industries.

This was seen particularly acutely in Germany, where output from energy-intensive industries fell by 15-20% in 2022 from its 2021 average. Other major EU industrial centres to see declines include Italy, France, Spain, Poland and the Netherlands.

While some of this can be attributed to energy efficiency improvements, demand side response and unmeasured solar generation, it is clear that “demand destruction” is also playing a role, notes Ember.

This has added toconcernsabout the competitiveness of European industry, because, if the nearly 5% rate of year-on-year decline in electricity demand continued throughout 2023, it would equate to the largest annual fall since 2009.

Overall demand had already started to fall towards the end of 2022, with a “staggering 8% decline from the same period in 2021, in part due to mild weather conditions”.

但天气条件将不太可能as favourable this year, therefore in order to ensure European competitiveness is not hampered, the EU would need to prepare to meet power demand without requiring demand destruction, says Ember.

In its report, Ember states:

“The first half of 2023 showed some encouraging signs for the energy transition. Fossil-fuel generation fell substantially, wind and solar power continued to rise, and other clean sources recovered from underperformance last year.

However, much of the fossil decline can be attributed to a significant fall in electricity demand, much of which is not sustainable or desirable. While trends of falling coal and gas generation must continue in order to achieve EU and country level targets on decarbonisation, Europe cannot rely on undesirable demand reduction to achieve this.”

Ember argues that the EU will need to push for continued electrification to reach its climate goals, as well as ensuring that conditions are right to increase renewable energy, to ensure coal and gas generation continue to fall without undesirable demand reduction.

Key enablers include streamlined permitting, grid expansion and adequate storage deployment, Ember says, as well as renewable generation.

In order to unlock the security and cost benefits of low-carbon power, it will be “essential” to put a coordinated approach at the top of the political agenda, Ember concludes.